Q2 2024

RECRUITMENT RADAR

15 years of BiermannNeff: a peek behind the scenes

15 years ago, at the end of the financial crisis, we had the idea of founding BiermannNeff. We started out as a small, specialised boutique in Zurich and within a few months had expanded our business to include an office in Germany. The development work was intensive, but a lot of fun – it went hand in hand with starting our families at the same time, and we each became fathers of three children in the early years (Jonas has three girls and Klaus three boys). Over the years, we put a lot of passion and energy into building and growing the company – and, of course, our families.

Focus and back to our own roots

At our peak, we employed almost 30 people in our offices in Frankfurt and Zurich. However, the larger BiermannNeff became, the more we realised that our original desire to find the best solution for our clients, to have more creative freedom, to be flexible and to act for the long term became increasingly less important. The bigger the team grew , the more “driven” we became – sales was a priority and the internal agenda dictated daily life. Instead of focusing on the essentials, we spent more and more time on internal management tasks and strategic considerations. The financial pressure was enormous and disproportionate to the benefits. We wanted to get back to our roots, to what drove us in the first place. After careful planning and intense discussions, we reduced our team to a healthy size and have since focused on our core competencies: supporting high profile searches in Asset Management, Wealth Management and Private Markets.

This was not an easy decision, but it was necessary in order to refocus and provide the best possible service to our clients. We have now been in business for eight years with the exact same core team. The successes and figures of recent years have shown us that the decision to downsize and return to our original focus was the right one. We have realised: Size alone is no guarantee of perfect service.

Pandemic and the importance of long-term relationships

The past few years have been marked by many challenges, but also by significant and very important learnings. The Covid 19 pandemic has shown us that we are successful, flexible and resilient in our new structure. Our approach to headhunting is to build long-term relationships based on trust. As a result, we have very little dependence on single clients. The majority of our clients are entrepreneurs, family offices or highly respected, often global, asset managers and banks looking to build or expand their business in Europe. These partners appreciate our values, our focused approach and the deep market knowledge we have built up over many years.

Times are changing and Diversity

A lot has happened in that time. People didn’t think about working from home in 2009, there were one or two good tie shops in every city centre, but people hardly wear them anymore. In our view, feedback culture has declined significantly. Opportunism has increased at the expense of loyalty, partly due to the coronavirus. Diversity has been the big issue in recent years, and networks, quotas and awareness-raising have contributed to a steady increase in the proportion of female candidates, for example. We expect this trend to continue, but it will be happening in waves. In recent years, almost 50% of the candidates we have placed have been female, in markets and sectors where the proportion of female candidates is 20-30%. The percentage of female candidates changing jobs is likely to decrease slightly as many female candidates have changed jobs in recent years and will therefore not be open to changing jobs again in the short term. In addition, the financial sector often shows little creativity in terms of the profile they are looking for when recruiting new employees. Platforms such as OpenBC, then Xing and now LinkedIn make our lives easier in many ways, but nothing beats trusted networks and relationships. We continue to cultivate these very intensively.

Entrepreneurial spirit in the financial industry

We have seen a lot of upheaval in our days and, along with the highs, a lot of uncertainty and mismanagement. In Switzerland, this culminated in the collapse of Credit Suisse. Margin pressure in the financial industry continues to increase, as do mergers and acquisitions in Asset Management. At the same time, we are seeing a lot of entrepreneurial spirit in the financial industry and many new asset managers have been established. Surprisingly, this trend seems to be stronger in Germany than in Switzerland.

Our work has always been about enjoying what we do, working with colleagues we trust, clients we enjoy serving and candidates who inspire and motivate us every day. And the financial aspect is also the result of dedication and enjoyment – not just in work, but in all aspects of life.

We look forward with confidence to the next 15 years of BiermannNeff and the new challenges and exciting projects that lie ahead!

Thank you for your trust!

Jonas and Klaus

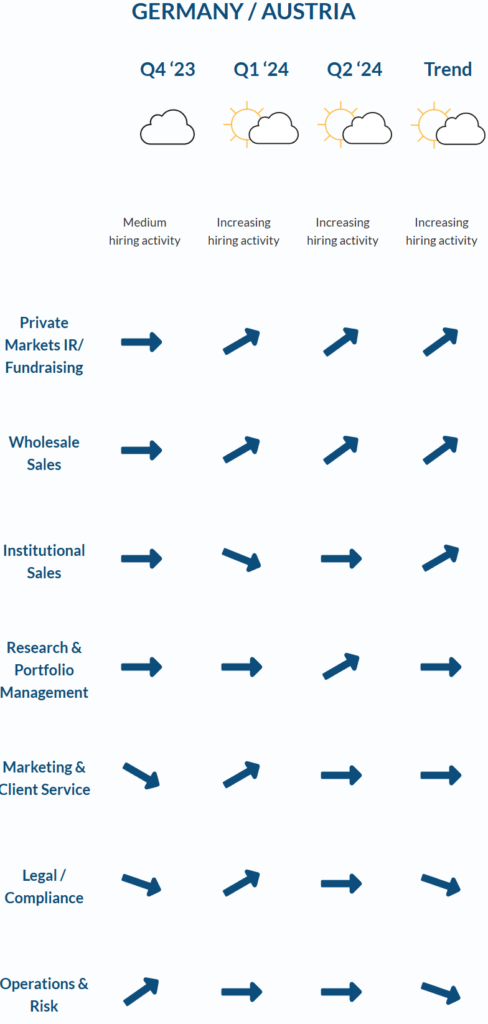

GERMANY / AUSTRIA

Q4 ‘23

Q1 ‘24

Q2 ‘24

Trend

Medium

hiring activity

Increasing

hiring activity

Increasing

hiring activity

Increasing hiring activity

Fundraising

SWITZERLAND

Q4 ‘23

Q1‘24

Q2 ‘24

Trend

Medium

hiring activity

Increasing

hiring activity

Increasing

hiring activity

Medium

hiring activity

Fundraising

EXCERPT OF ASSET MANAGEMENT MOVES IN GERMANY IN Q2 2024:

- Hired Bernd Vogel as Head of Insurance – Central & Eastern Europe from Alliance Bernstein

- Hired Alexander Schicho as Investor Relations & Business Development – DACH from Kartesia

- Hired Gunter Schäfer as Chief Sales Germany | Communications | Marketing Officer from ÖKOWORLD LUX S.A.

- Hired Josef Scarfone as Head of Distribution Germany & Austria from Skagen Funds

- Hired Sigrid Rosemeyer as Managing Director Fund Investor Relations from Capital Group

- Hired Felix Plechinger as Vice President – Client Solutions Europe from PIMCO

- Hired Alexander Patz as Entrepreneur Fund Sales from Flossbach von Storch

- Hired Maximilian Palbuchta as Sales Manager Wholesale from KSK MSE

- Hired Antonis Maggoutas as Managing Director, Head of DACH Institutional Business Development from Federated Hermes Limited

- Hired Bernhard Lerchl as Head of Institutional Sales from Hypovereinsbank

- Hired Michael Krautzberger as Global CIO Fixed Income from BlackRock

- Hired Helmut Kotschwar as Head of Portfolio Management from Quanstra Solutions

Hired Heike Ahlgrimm as Director Fund Sales from Flossbach von Storch

Hired Heike Ahrens as Director Institutional Sales from Nordea

Hired Nunzia Thiriot as Director Institutional Clients from Credit Suisse

- Hired Stephan Bannier as Managing Director from Generali

- Hired Marcus Becker as Principal Private Equity from Fisch Asset Management

- Hired Saskia Bernhardt as Head of Financial Institutions Germany & Austria from Lupus Alpha Asset Management

- Hired Max Bock as Head of Wealth Clients Germany & Austria from DWS

- Hired Tobias Böttger as Relationship Manager from Kieler Volksbank

- Hired Immo Gatzweiler as Sales Director from AXA Investment Management

- Hired Thomas Huth as Partner Investment Consulting & Fiduciary Management from Funding Solutions

- Hired Alexander Ilgen as Chief Financial Officer, Head of Corporate Development from Deutsche Bank

Hired Olaf John as European Client Solutions Director from Mercer

Hired Miriam Uebel as Deputy Head of Europe, Institutional from UBS

Hired Florian Volgger as Investor Relations Manager from Golding Capital Partners

Hired Jan von Graffen as Managing Director from HIH Invest Real Estate

Hired Simon Werkheiser as Senior Client Advisor, Executive Director from Invesco

Hired Michael Wiese as Director from Gothaer

Hired Michael Buchholz as Head of Distribution from UBP (Union Bancaire Privéé)

EXCERPT OF ASSET MANAGEMENT MOVES IN SWITZERLAND IN Q2 2024:

- Hired Sven Simonis as Head of Client Solutions / Member of the Leadership Team from Credit Suisse

- Hired Mick Schneider as Managing Director, Head of Switzerland, Liechtenstein and Intermediary Austria from BNY Mellon

- Hired Elemer Schneider as Head of Wholesale from Fisch Asset Management

- Hired Tatjana Puhan as Head Asset Allocation from Copernicus

- Hired Fedor Plambek as Head of Marketing and Sales from Janus Henderson

- Hired Philip Neuschäfer as Senior Sales Manager from UBS

- Hired Pascal Mischler as Managing Director from Kieger AG

- Hired Boris Maeder as Managing Director – Head of International Private Wealth from UBS

- Hired Simon Lussi as Partner from Capvis AG

- Hired Philipp Lisibach as Head of Strategy & Research from Credit Suisse

- Hired Fabian Linke as Head Real Estate Business Development Switzerland from Swiss Prime Site Solutions

- Hired Susanne Kundert as Head Investments from ESG-AM

- Hired Òscar Andreu as Head of DACH Region (Switzerland, Germany, Austria) from HSBC

- Hired Daniel Durrer as Head Distribution Switzerland from AMG Fondsverwaltung

Hired Carl Hollitscher as Head Institutional Business Austria & Switzerland from Franklin Templeton

Hired Cynthia Strahm as Senior Relationship Manager Institutional Clients from Vontobel

Hired Geraldine Sundstrom as Head Investment Offering from PIMCO

Hired Christoph von Reiche as Head Institutional Clients from Robeco

Hired Christian Zeitler as Head Intermediary Switzerland from GAM Investments

Hired Pascal Weber as Director, Wholesale Switzerland from Credit Suisse

Hired Lukas Willi as Senior Sales Executive from Franklin Templeton

EXCERPT OF ASSET MANAGEMENT MOVES Rest of Europe IN Q2 2024:

Hired Steven Gardner as Head of Asset Management Sales & Client Relations, UK from Berenberg

Hired Fraser Lundie as Global Head of Fixed Income from Federated Hermes Limited

Hired Barry Glavin as Head of Equity Investment Platform from State Street Global Advisors

Hired Mark Hawtin as Head of the Global Equities Team from GAM

Hired Volker Samonigg as Head of Client Partner Group from Barings

Hired Marjolein van Dongen as Chief Client Officer from Amundi

Hired James Young as Director Switzerland – Germany – Austria from Stoneweg SA

Hier geht es zum Recruitment Radar Q1 2024

Hier geht es zum Recruitment Radar Q4 2023

Hier geht es zum Recruitment Radar Q3 2023