Q1 2024

RECRUITMENT RADAR

We are celebrating our birthday, 15 years of BiermannNeff!

When we ventured into self-employment at the beginning of 2009, we were just at the end of the financial crisis and quite a few of our friends and acquaintances were wondering whether this was the right move. Fortunately, we were not dissuaded. The financial sector has changed fundamentally since 2009 and we have also undergone a major transformation. After the office in Zurich, we opened the office in Frankfurt just a few months later and steadily expanded our team over the following years. With a team size of just under 30 employees, the amount of time spent on internal matters became ever greater – and the time for clients and candidates ever less. We were moving further and further away from what we love so much about our work: the dialogue with clients and candidates, networking and recruiting. We therefore radically streamlined our team in 2016 and have since focused on the three areas in which we have been very active and successful from the very beginning: Asset Management, Wealth Management and Private Markets in Europe. In order to be as well prepared as possible for the changes in the financial industry, we are also thinking hard about the best structure for our clients. We are convinced that, as an executive search boutique with a clear focus, an agile organisation and a structured but pragmatic approach as well as short communication channels, we offer our clients the best benefits. We are very happy with our clear and lean setup and know that we can provide much better advice without the „politics“ of a large institution. With this in mind, we would like to thank all our clients, candidates and confidants for their appreciation and loyalty over the past few years. A very special thank you also goes to our team!

Increased demand on specialists – developments in Asset & Wealth Management since the financial crisis

The Asset & Wealth Management industry in Europe has changed considerably since the financial crisis of 2008. The industry has become more professionalised and much more diverse. Assets under management have grown, while at the same time the pressure on profitability has increased substantially, for example due to (active) ETFs and new providers. The product range has changed massively, particularly in the area of alternative products. Providers in this area now make up a large proportion of our clients. The topic of ESG has developed enormously. Even though we are currently noticing a certain „calming down“ of the topic, we see continuing demand to invest in this area. Digitalisation has led to an upswing in robo-advisors, which appeal to younger investors in particular. By utilising data analytics, providers can also respond much better to the individual needs and goals of their customers. Along with these developments, the demands on employees have also changed considerably. In a world characterised by data and analyses, strong analytical skills are essential. Advancing digitalisation has fundamentally changed the way Asset Management and Wealth Management are conducted. Employees need to be familiar with the latest technologies. They must also have strong communication skills to build client relationships, create trust and explain complex financial concepts in an understandable way. The ability to respond to customers‘ individual needs and offer customised solutions is crucial. Overall, the requirements for specialists in Asset and Wealth Management have evolved considerably since 2009. In addition to sound specialist knowledge, technological expertise is now also crucial for success. And, of course, professionals must be prepared to continuously develop their skills in order to meet the changing demands of the industry.

Salary structures – 2009 to today

The fact that salaries in the financial sector are a very decisive factor has not changed over the years. In our annual salary reports, we always provide a rough overview of the industry. However, we also discuss very specific salary structures with clients and help them to develop new salary models. Our overviews and comparisons give a clear picture of the competition, but this service is also available to candidates at any time.

Comparing our salary data from 2009 with 2024 gave us the following picture:

Our interpretation of the figures:

- Many fixed salary increases in recent years, initially due to new regulatory conditions, have not led to a shift from bonuses to fixed salaries, but rather have tended to increased total compensation additionally.

- The pressure on profitability has hardly ever been felt in terms of salaries in recent years.

- The Private Markets sector has had a massive impact on salaries, particularly in sales and at senior level. Many new or international market participants turned to candidates from traditional asset managers and paid higher salaries, which led to a certain salary spiral. We believe that these segments will separate from each other in the medium term and that salaries will develop differently. Private Markets salaries tend to remain stable to rising and in traditional Asset Management, we see a trend towards lower salaries, but with a much greater spread of salaries (no more watering can).

- The general shortage of talent has led to a very sharp rise in salaries for people with less but qualified professional experience, especially in the last 5 years.

In the coming weeks, we will be reporting on LinkedIn about what we have experienced over the last few years, what we have learnt, what we would do differently today and what we would do again. Thank you very much for your trust!

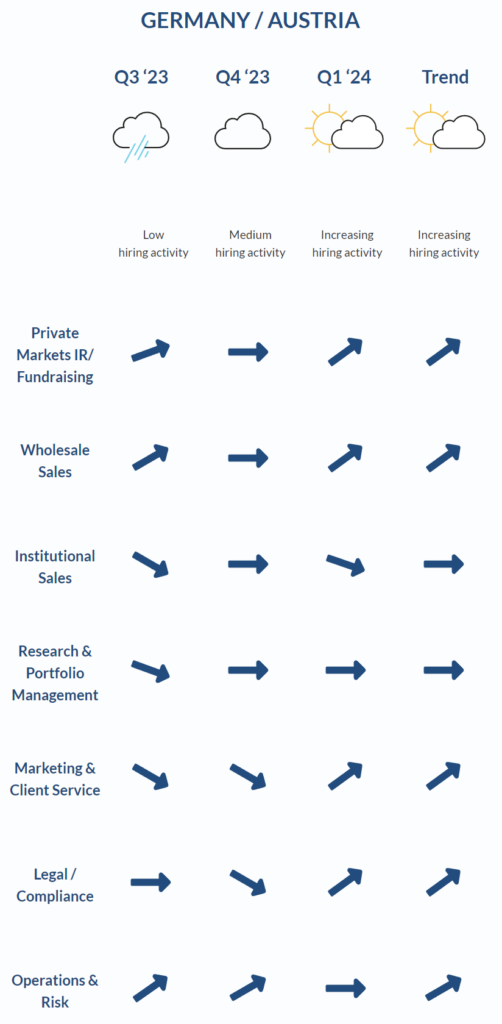

GERMANY / AUSTRIA

Q3 ‘23

Q4 ‘23

Q1 ‘24

Trend

Low

hiring activity

Medium

hiring activity

Increasing

hiring activity

Increasing hiring activity

Fundraising

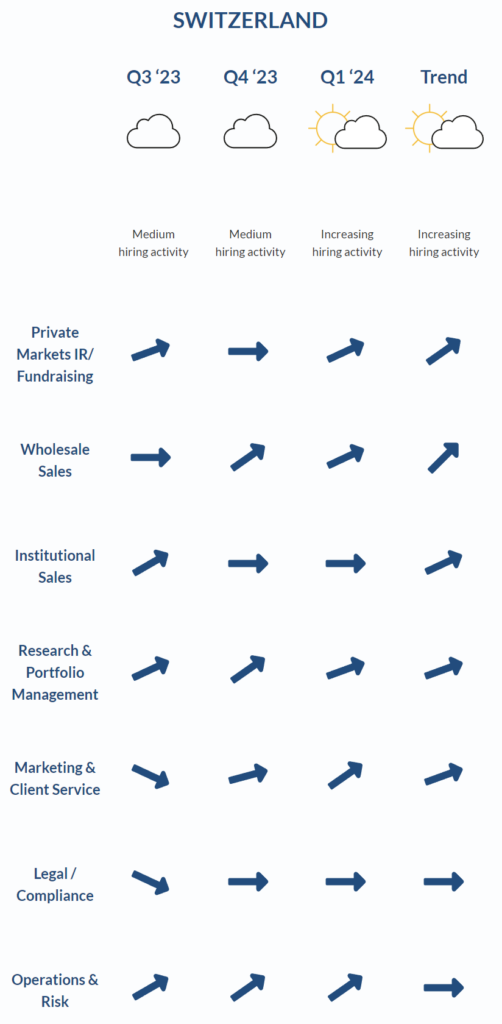

SWITZERLAND

Q3 ‘23

Q4 ‘23

Q1 ‘24

Trend

Medium

hiring activity

Medium

hiring activity

Increasing

hiring activity

Increasing hiring activity

Fundraising

EXCERPT OF ASSET MANAGEMENT MOVES IN GERMANY IN Q1 2024:

- Hired Thomas Adler as Managing Director, Investment Manager from Invesco

- Hired Antonio Nicodemus as Managing Director, Investment Manager from Flossbach von Storch

- Hired Jakob Wiggert as TBA from Architas Multi Manager Limited, and hired several other senior institutional sales professionals

- Hired Markus Lueck as Sales Director from Invesco

- Hired Andreas Metzen as Business Development Director from Altamar CAM Partners

- Hired Maximilian Palbuchta as Sales Manager Wholesale from KSK MSE

- Hired Christian Rössling as Head of DACH Sales from Arcmont Asset Management

- Hired Nikolaos Soumelidis as Portfolio Manager from BNP Paribas

- Hired Louis Frank as Senior Sales from BNP Paribas

- Hired Denise Koch as EFT Sales Manager from DeKaBank

- Hired Maximilian Loebermann as Senior Sales from Berenberg

- Hired Hermann Pfeifer as Country Head Germany, Austria CEE & Greece from Amundi

- Hired Robert Hofmann as Portfolio Manager from Allianz Global Investors

- Hired Sabine Stahl as Head of Wholesale Sales. Before her break she has been with J.P. Morgan Asset Management

EXCERPT OF ASSET MANAGEMENT MOVES IN SWITZERLAND IN Q1 2024:

- Hired Nicole Crettenand as Head of Institutional Investors from Lombard Odier

- Hired Bettina Ducat as Co-Head Asset Management from Financière de l’Echiquier

- Hired Andrew Jackson as Head of Fixed Income from Credit Suisse

- Hired Christoph von Reiche as Head Institutional Clients from Robeco

- Hired Justine Kreis as Managing Director, Head of Alternative Investment Group EMEA from Credit Suisse

- Hired Alain Meyer as MD/ Head Intermediaries EMEA & Head DACH from PineBridge Investments

- Hired Peppi Schnieper as CEO from Bain & Compagny

- Hired Sven Simonis as Head of Client Solutions from Credit Suisse

- Hired Mark Vallon as Senior Consultant from BlackRock

- Hired Ramon Vogt as Head Sales Wholesale Switzerland, Deputy Head Global Sales from Vanguard

- Hired Lucia Waldner as CEO from CC Trust Group AG

- Hired Giovanna Cilia as ETF Distribution from UBS

- Hired Sandro Gschwend as Managing Director, Head Client Solutions from Credit Suisse