Q4 2023

RECRUITMENT RADAR

New year, new luck.

The past year, 2023, was characterized by significant upheavals and changes. The hiring activity, which is very important for our business, experienced a noticeable resurgence in search activity in Continental Europe in the last three months of 2023, following two rather quiet second and third quarters. Falling interest rates acted as a remedy, and there is hope that the positive trend, combined with a positive sentiment for Private Equity, Venture, and now Crypto, can continue in the coming quarters. Accordingly, we look more positively towards the year 2024 – which is also reflected in current discussions about potential mandates with our clients.

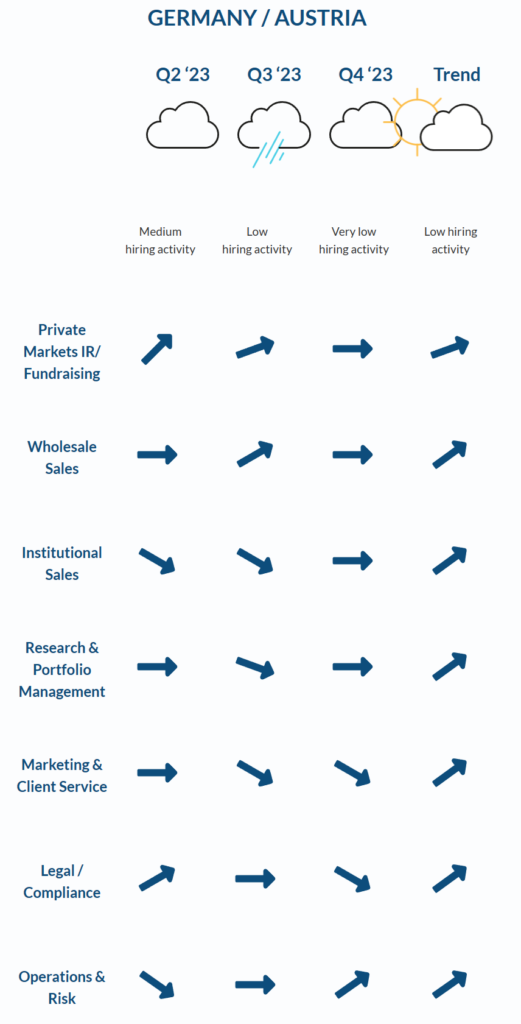

GERMANY / AUSTRIA

Q2 ‘23

Q3 ‘23

Q4 ‘23

Trend

Medium

hiring activity

Low

hiring activity

Medium

hiring activity

Increasing hiring activity

Fundraising

SWITZERLAND

Q2 ‘23

Q3 ‘23

Q4 ‘23

Trend

Low

hiring activity

Medium

hiring activity

Medium

hiring activity

Increasing hiring activity

Fundraising

Expanding Private Wealth Hiring in Private Markets: A Growing Trend

- Historical Focus: Private market firms in Europe historically concentrated on institutional clients (e.g., pension funds and insurance companies).

- Shift in Strategy: Now, they are redirecting their hiring efforts towards building a strong client base in wealth management.

- Strategic Partnerships: The strategic focus is on establishing partnerships with global financial institutions and private banks, enabling individual clients to access private market investments.

- Industry Leaders: Leading industry players like Blackstone, KKR, Ares, and Apollo have already established dedicated private wealth divisions, initially in the USA and later expanding internationally, including Europe.

- Industry-Wide Adoption: Other private market firms are actively working to follow suit and establish corresponding teams.

Challenges in this transition include a limited pool of candidates with expertise in private markets in different regions, knowledge gaps, and cultural differences when hiring from related areas, and the complexity of managing decentralized teams.

- Limited Talent Pool: The pool of candidates with expertise in private markets in different regions is often small due to the scarcity of pure-play private markets providers with established local private wealth teams.

- Hiring Challenges: Hiring professionals from related areas like private banks or traditional asset management can introduce knowledge gaps and cultural differences.

- Management Complexity: Managing decentralized teams can be complex, especially for firms accustomed to having their personnel located in a single location.

Professionals transitioning from traditional financial institutions are highly sought after due to their extensive networks and their good understanding of how banks operate, which helps in building trustworthy and long-term partnerships. Private market firms offer substantially higher salaries than traditional asset managers, making the switch more attractive. Candidates with experience in both private wealth and private markets are particularly sought after, though they are relatively rare.

- Desirable Qualities: Eligible candidates that have built strong client networks and understand how banks and other global financial institutions operate.

- Financial Incentives: Private market firms offer substantially higher salaries, adding to the appeal of the transition.

- Rare Expertise: Candidates with experience in both private wealth and private markets are highly valued, even though they are not common.

The hiring trend is not solely driven by financial incentives; it is also influenced by the perception that private market firms offer more appealing and aspirational roles for candidates. As these firms aim to expand their private asset distribution in the private wealth channel, they are broadening their talent pool and setting high standards for education, career background, and a proven track record of achievement.

- Attractive Roles: Candidates are drawn to private market firms for aspirational roles and career opportunities.

- Elevated Standards: Private market firms are raising the bar for education, career background, and track record of achievement in their hiring criteria.

Despite the challenging fundraising environment in Europe, private market firms remain committed to building and expanding their private wealth coverage, underscoring their confidence in the sector’s long-term growth potential within the private markets arena.

EXCERPT OF ASSET MANAGEMENT MOVES GERMANY IN Q4 2023:

- Hired Murat Bakir as Head Wholesale from Flossbach von Storch

- Hired Albrecht Bassewitz as Head Investment and Pension Solutions Germany from Swiss Life AM

- Hired Julian Börner as Institutional Sales from Flossbach von Storch

- Hired Caterina Ket as Associate Director Fund Marketing from Mercer

- Hired Patrick König as Head of Investor Relations DACH from Blackrock

- Hired Geraldine Kieren as Director Investor Relations from Financial Services Capital

- Hired Sebastian Römer as Head of DACH Sales from Natixis

- Hired Francesca McDonagh as CEO from Credit Suisse

- Hired Thorsten Winkelmann and his team as CIO European & Global Growth Equities from Allianz Global Investors

- Hired Norman Lesser as Senior Wholesale Sales from Invesco

- Hired Christoph Ohme as Head of German Equities from DWS

- Hired Markus Taubert as Principal from Muzinich (new presence in Germany)

- Hired Johanna Handte as CIO – Global Head of Asset Allocation from DWS

- Hired Peter Reichel as MD Client Portfolio Management from Blackrock

EXCERPT OF ASSET MANAGEMENT MOVES IN SWITZERLAND IN Q4 2023:

- Hired Rochus Appert as Head of Switzerland from Columbia Threadneedle Investments

- Hired Cristian Pappone as Regional Head Switzerland & Austria from Vontobel

- Hired Maximilian Beeck as Head of Wholesale Switzerland & Austria from Janus Henderson Investors

- Hired Ivo Mathias Buschor as Head of Sales Switzerland from Credit Suisse

- Hired Isabel Faragalli as Managing Director of Investments from Credit Suisse

- Hired Tomislav Culic as Director Global Wealth Solutions – Switzerland from HSBC

- Hired Grégoire Glotin as Business Development Director for French-speaking Switzerland from SILEX Investment Managers

- Hired Martin Bloch as Head of Client Solutions Switzerland from Principal Global Investors

- Hired Dimitri Bellas as Head of ETF Distribution Romandie from Credit Suisse

- Hired Sandra Cafazzo as Head of Switzerland from Robeco

- Hired Patrick Sege as Head Client Relationship Management & Marketing from Vontobel Asset Management

- Hired Cyril Berchthold as Head of Institutional Sales Switzerland from Natixis

- Hired Ivan Nikolov as Co-Head Convertible Bonds from an independent advisory role

- Hired Moritz Dechow as CEO Clearstram Fund Centre from Credit Suisse

- Hired Markus Studer as Head Product Platform from Blackrock

- Hired Laura Geiger-Pancera as Country Head Switzerland from HSBC